-

Posts

2,024 -

Joined

-

Last visited

-

Days Won

1

Content Type

Profiles

Forums

Blogs

Events

Everything posted by AJSP

-

Oof, Guinness must be rare as rocking horse shite then. At least you found an alternative...........Pie looks ok but missing some veggies maybe ?

-

Have you tried over the road in The Brick House- food ok and pretty sure they do Guiness

-

Well, that was worth the watch, very thought provoking for those who have wives from NE Thailand who have moved overseas to join their foreign husbands ( I all into this category) It was depresssing at times but also having some positives and with this social documentaries, it is a record of what goes on in real life, sacrifices we make and things we do in seeking out a better life. The latter part of the documentary dealt with death, heartache, betrayal and ill health with a smattering of positivity with one of the ladies Thai born Sons being accepted into a prestigious Capital City Hotel on a catering apprenticeship. For me, it was a reminder of what my wife has scarified to come to the UK and raises the question of would I have done the same for her?.

-

Noticed there is an interesting documentary on the telly tonight (UK).Focuses on Denmark. Should be worth a watch Fishing for Love: How to Catch a Thai Bride Storyville A Storyville documentary. In a small fishing community on the west coast of Denmark, over 900 Thai women are married to local fishermen. The trend started 25 years ago when Sommai, a former sex worker from north east Thailand, married Niels. She became a matchmaker for lonely Danish locals and impoverished women from her village in Thailand. At first, these stories seem straightforward: white men from a wealthy country marrying Asian women looking for a way out of poverty, but a different, far more complex and surprising tale unfolds in the film. Over ten years, acclaimed film-maker Janus Metz and film-maker and anthropologist Sine Plambech follow four Thai-Danish couples in an intimate chronicle that explores universal questions of love and romance, while navigating wildly different cultures, and compromises that shift gradually and surprisingly from sacrifice to life choices.

-

Plus 1 Ditto direct every time for me.

-

I’m not the romantic one but do make an effort as it’s appreciated if I do make an effort and expected by my Mrs. I’ve bought her a few Ralph Lauren T shirts ( Xmas sale). Will buy a small bunch of flowers on Friday plus going out for a meal in the evening to a sea food restaurant.

-

Looks excellent and great value as well

-

Looks ok. What was the verdict. ?

-

What's your baht worth? Exchange rates on the street...

AJSP replied to Painter's topic in All about the Baht

The upward trend seems positive to me. Commenting from a GBP point of view -

Who is this guy....& what is the connection to here?

AJSP replied to coxyhog's topic in General topics

Let’s hope the ref didn’t call a foul shot and had to reposition the white -

Good offer but I reckon you should advertise the day before to generate a bit more trade

-

Who is this guy....& what is the connection to here?

AJSP replied to coxyhog's topic in General topics

Two thoughts. hope it was a bird and hope he wasn’t a whirlwind in the sack -

Great photos looks interesting. It’s one thing I’d like to do when I spend more time in Thailand is to travel

-

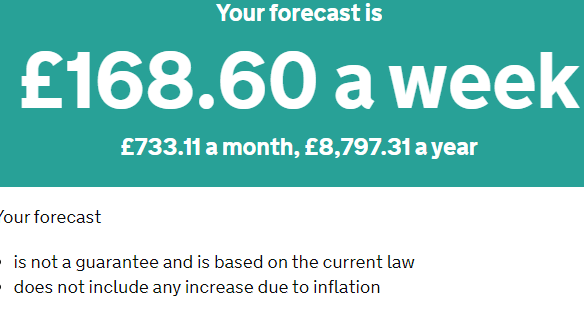

Two years in retirement, let’s have a look back.

AJSP replied to Thai Spice's topic in General topics

Spot on. Will be means tested for sure and it’s not a fair system -

Two years in retirement, let’s have a look back.

AJSP replied to Thai Spice's topic in General topics

By the way, Thai Spice, good thread and nice to see you update it -

Two years in retirement, let’s have a look back.

AJSP replied to Thai Spice's topic in General topics

-

Restaurant which used to sell kangaroo and crocodile

AJSP replied to andycoll's topic in Western Food in Thailand

-

I do a bit of property here in the UK and regular newsletters from Savills who we sometimes work with. I don't normally take much notice of the Real Estate Tips outside of the UK but this caught my eye. No mention of Thailand but they are suggesting Vietnam as the next SE Asia hotspot. I am not savvy enough to try and understand the Thai Economy or market but it does seem that other nearby countries are now catching up and possibly overtaking Thailand. You'll note in the article they still consider Vietnam to have barriers to boosting the economy but are working towards having a medium term plan to deliver a stable national economy, which Thailand has yet to establish. Market trends Real estate investment tips for 2020: Asia-Pac January 2020 Against a backdrop of geopolitical tensions, regional uncertainties linger. India and Vietnam are future bright spots Simon Smith Head of Asia-Pacific Research Asia-Pacific’s investable real estate universe is fast growing and extremely diverse. Differing cycles are creating different pockets of risk and opportunity, while the emergence of new asset classes is providing investors with a much broader range of options and strategies. Vietnam appears to be a future bright spot (Ho Chi Minh City, above), with strong economic growth and a youthful demographic profile. But, investable assets remain scarce. Administrative hurdles continue as anti-corruption measures bite, in turn reducing liquidity and delaying development progress. However, over the medium term, this will establish sound governance and a better business environment, benefiting investors. India, whose population is forecast to overtake China’s in the next five years, offers longer-term opportunity. The government has taken measures to boost the economy by reducing corporate taxes and re-capitalising banks. The central bank lowered the benchmark interest rate five times during 2019. These measures will drive occupier demand for traditional asset classes such as offices, but there are also real opportunities in alternatives. Co-living is one such example, supported by India’s huge millennial population. Australia has experienced the worst and earliest bush fires in its history. Although still ongoing, the current damage to businesses and property is expected to have a near-term negative impact on GDP, mainly from a fall in farm production, private investment and tourism, albeit somewhat offset by government aid and unprecedented donations. Financial markets have also increased their expectation of an interest rate cut, but these are already at historic lows and there are doubts that they are still positively impacting the economy. At a regional level, uncertainties still linger against a backdrop of geopolitical tensions, US trade relations and slowing economic growth. This has meant the emergence of a degree of downside risk to some countries in the region in 2020, particularly export-orientated economies, as investors remain more inclined to invest in real estate markets viewed as better insulated from such risks. In the near term, looser monetary conditions will continue to support real estate markets as external and domestic headwinds mount. Core investors will continue to seek opportunities in the office sector, in spite of low yields, focused on major cities across the region. Yields across most Asia-Pacific markets seem to have bottomed out. As a result, investors are searching for higher-yielding assets. Alternative asset classes, such as self-storage, data centres and senior housing, are benefiting. * Apologies for the size of the images !

-

Weins is good. Watched a few of his Lebanese vids last night in bed. Was 9.30pm and Id eaten but by the time i'd finished watching was starved LoL

-

Exchange rate makes it dear IMHO. £50 = best part of 2000 THB

-

I heard that from Devon folk ( ilfracombe) and as I am from from Somerset it’s not a term I’ve heard prior. That said, Caravan folk are rife in the south west and our motorway junction at Gordano is Choca. never seen one in Thailand but do joke wit the Mrs about a Max n Paddy adventures 🤣

-

-

Wow. That sounds awful i do like the straight message at the end and well put. i hope the situation improves soon

-

Tricolour

-

Snap